Polygon crypto strives for 100-150% increase after CEO change

Important insights:

- Polygons $ pole shows an interest bully falling wedge pattern that indicates a possible outbreak.

- The appointment of CEO Sandeep Nailwal strengthens the growth prospects of polygon.

- A price increase of 100-150% could be carried out if there is an outbreak via important resistance.

Sandeep Nailwal, the co -founder of polygon, was appointed CEO of the polygon foundation. It is expected that this change of management of the cryptocurrency Polycon gives new swing.

This could lead to an increase in the $ pole token. In view of the significant market movements that are emerging, an outbreak of the course could be imminent.

Technical chart of polygon crypto indicates a strong bullish momentum

According to market analysts, $ pole could form a Descending Breading Wedge pattern in the current market. An interest bully trend in the cryptocurrency polygon could soon be emerging, driven by a strong momentum and change of leadership.

The graphic shows that Polygon moved in this trend. The course has reached the upper limitation of the wedge. This is usually a clear indication of an upcoming outbreak that can lead to a massive increase in the course.

The course of the course showed a gradual accumulation of starch. If the course overcomes the resistance area, an increase of 100-150% can be expected.

The chart aims at a movement that would bring the Polycon Crypto course to about $ 0.400. With the current courses, he has a massive upward potential.

In addition, polygon is strengthened as an important player in the Layer 2 blockchain ecosystem, which is attractive for both private investors and institutional investors.

New CEO positions polygon to strategic changes

In addition to the technical analysis, the recent change in the management of polygon is also crucial for the company's potential growth. The co -founder of polygon has been appointed CEO of the polygon foundation.

The company focuses on accelerating its development. This strategic step also strengthens its position in the blockchain sector.

The appointment of Nailwal is a strategic step to promote the company's mission. Polygon has set itself the goal of becoming a leading force in the scaling of Ethereum and Layer 2 solutions.

His leadership has rejected interest in the Agglayer interoperability protocol. This protocol tries to standardize fragmented blockchain ecosystems.

Polygon also intends to abolish the ZKEVM chain by 2026. It focuses on modifying its proof-of-stake (POS) Sidechain in such a way that it scales on more than 100,000 transactions per second.

Bullische U -turn inevitable? The falling wedge of polygon ($ pol) indicates the exit from Breacompany

The chart of the polygon crypto price shows a falling wedge pattern that indicates a possible trend reversal. The course has reached lower lows and lower highs. However, the downward dynamics slowed down, so that an outbreak upwards becomes more and more likely.

PC acted at $ 0.2334 at the time of going to press, which corresponds to an increase of 3.41% and indicates an upward trend. If the course overcomes the resistance of the wedge, a clear increase should follow, the chart image is targeting the $ 0.400 mark.

The technical indicators also support the interest bully momentum. The Stochastic RSI shows a value of 100. This means that the momentum is directed upwards.

The MacD also showed an interest bullic crossover, with the MacD being above the signal line. The RSI was 55.78, which indicates that it is not yet overbought, and there is more scope for the price movement.

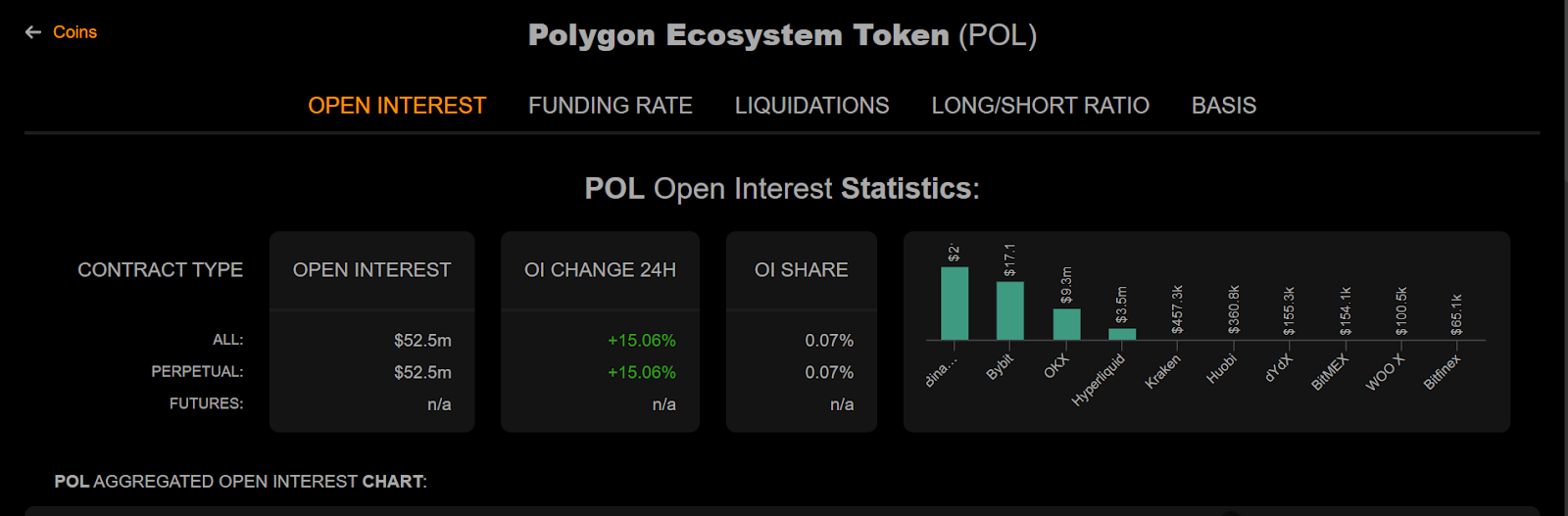

Increasing open interest in polygon crypto futures signals market optimism

Another indicator of the trust of the market in polygon is the significant increase in the Open Interest (OI) for $ pole futures. In the course of the last day, the Oi has the Polygon-Futures A new all -time high of $ 52.5 million, which corresponds to an increase of 15.06%.

The increase in open interest signals a growing interest of investors in polygon crypto futures contracts. More dealers are involved in $ pole, which reflects an increased market activity.

This trend indicates greater confidence in the future development of the token. An interest bully price movement could be emerging.

The increase in the OI shows that more investors rely on the future price of $ pol. With the growing interest of the institutional investors in polygon, the general mood on the market is becoming more and more bullish.

The capital inflow in $ pole futures indicates that the market expects a high price increase, since the dealers are preparing for profits.

Disclaimer

This article only serves for information purposes and does not represent financial, investment or other advice. The author or the persons mentioned in this article are not responsible for financial losses that can arise from investments or trade. Please research yourself before making financial decisions.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.