SUI Crypto exceeds $ 45 billion total volume of the aggregators, plus 19.22%, time to buy?

Important insights:

- Sui Krypto exceeds $ 45 billion in volume, which reflects strong market growth.

- The increase in the volume of SUI by 19.22% within 30 days is impressive.

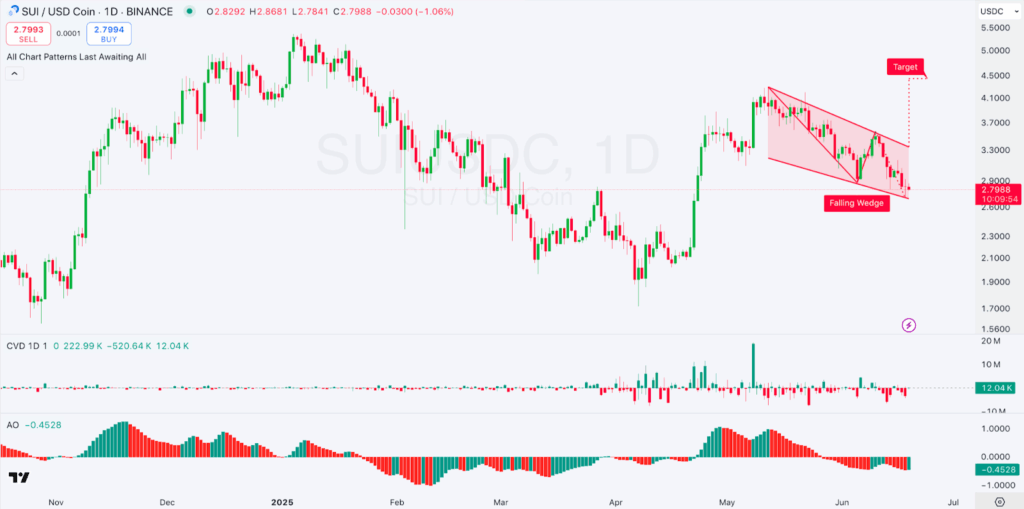

- A falling wedge pattern indicates a potential interest bully outbreak with a price target of $ 4.50.

Sui Crypto recently exceeded a total volume of over $ 45 billion. This corresponds to a good increase of 19.22% in the last 30 days.

Sui Crypto's aggregator Volume exceeds $ 45 billion

On June 19, 2025, the aggregator volume of SUI was $ 45,722,501,477. The average volume per month was $ 2,540,138,970. This sudden increase in volume shows the growing interest SUI And the increase in market activity.

When examining this data, we find that the trend has reached a new high and has been at this level for several months. This has been the case at least since the end of 2024. The graphic shows the constant increase in the monthly trade volume.

A constant increase in the level has been determined since the beginning of 2024 to June 2025. This proves that the acceleration of the total volume is not a temporary factor, but a tendency that lasts for several months. The graphic shows that the increase is the result of many projects and sources of liquidity. The large aggregator platforms such as Aftermath, FlowX etc. play an important role. The use of these platforms has significantly increased the volume due to the simplicity of trade and the stronger integration of the market.

During the last one -month period, the Sui recorded that Recently on ETF applications increasean increase in volume by 19:22, which indicates that the mood of the investors is very optimistic. Such percentage growth shows the rapid development of the token regardless of the possible changes on the market.

Sui Crypto Technical Analysis

Sui-Charts show that a falling stretcher has formed, which is generally considered an indication of an interest bully trend reversal. The falling wedge has a price range that is getting smaller downwards and is defined as an area between two trend lines that meet. It shows that volatility slowly decreases. Such a pattern can be viewed as a harbinger of an outbreak when the course breaks out from the limits of the wedge.

The falling wedge in the case of SUI indicates that the token is in a consolidation trend before the possible outbreak. If the trend continues, the potential price target of SUI can be the area around $ 4.50 mark, which would mean significant growth in the current trading price of the coin, since it is currently at an average price of $ 2.80.

The trend of the cumulative volume field (CVD) from Sui, the recently turned over by hyperliquid. Is positive and the purchase pressure should be stronger than the sales pressure. This is in accordance with the course of the course that moves upwards. The fact that the CVD has increased indicates higher demand and more securities in SUI. In the meantime, the Awesome Oscillator (AO) shows a light interest bully divergence. And the number of green bars increases: the momentum increases.

The two indicators support the opinion that the token can go up in its upward trend. Because the buyers have increased on the market.

The sales pressure is also low during the falling wedge, as the decreasing volume shows during the consolidation phase. This deficit in sales is a sign that the bears lose their influence. And the bulls are slowly finding right as soon as the course breaks out. The price could explode above the upper trend line.

Disclaimer

This article only serves for information purposes and does not represent financial, investment or other advice. The author or the people mentioned in this article are not responsible for a financial loss. that can arise from investments in or trading shares. Please research before making any financial decisions.

Brenda is additionally a news writer on the coin chapter. Brenda commits to producing excellent, well-optimized content to ensure consumer satisfaction. She has developed expertise in technical analysis and price forecasting of breaking blockchain news while at the coin chapter. Additionally, she enjoys engaging in stock markets and investing in cryptocurrencies.