Here is why old coins crashed

The cryptocurrencies crashed accelerated on Sunday and Bitcoin fell under $ 100,000 for the first time since May 8. The course has fallen by over 10 % since its high this year and is now in a correction.

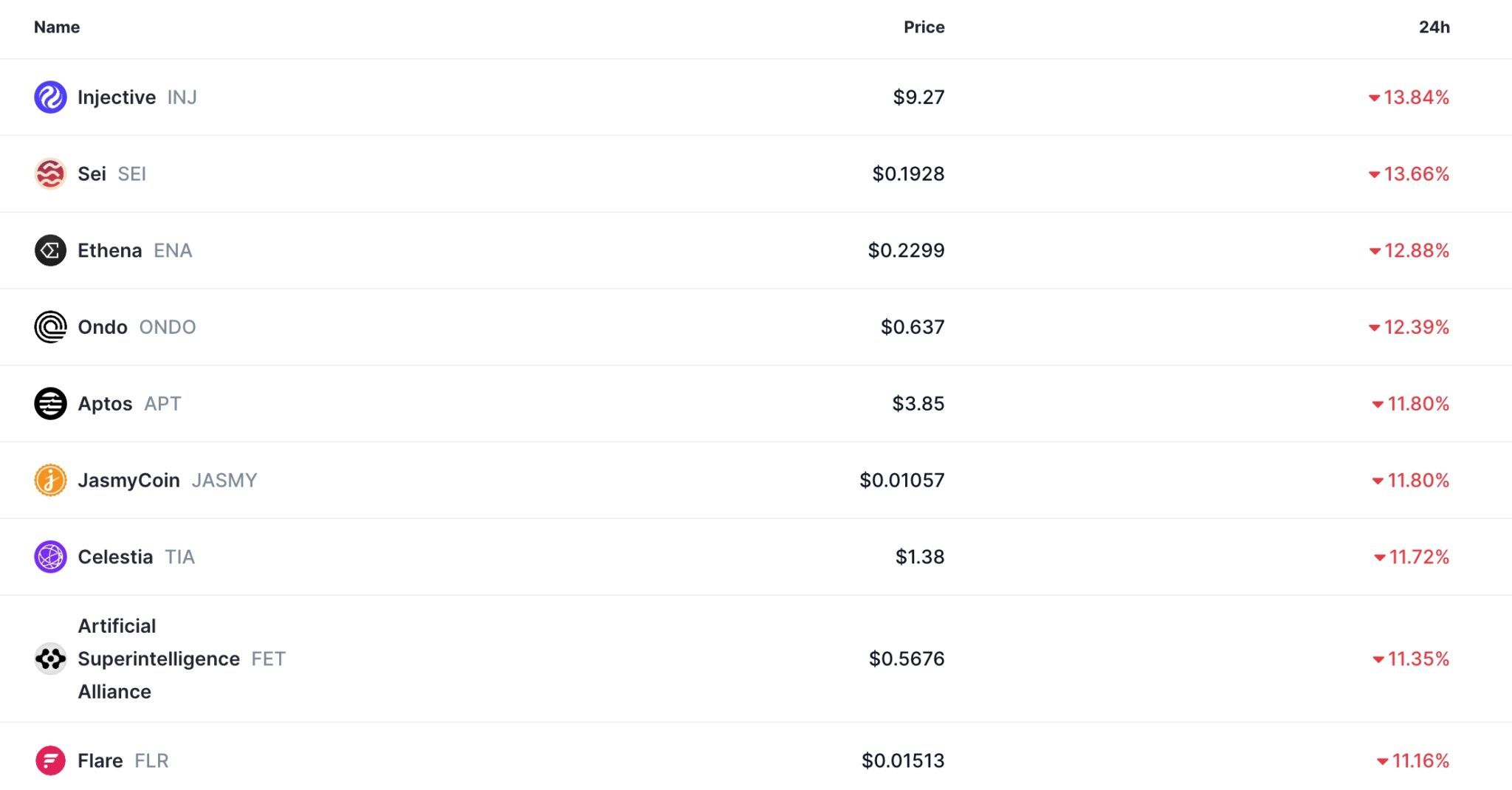

Altcoins have crashed even more: popular tokens such as its, injective, ondo, ethena and jasmy have fallen by more than 10 % in the last 24 hours. The entire market capitalization of cryptocurrencies has fallen over $ 3 trillion in the last 24 hours, while the liquidations have risen by 154 % to over $ 1 billion.

Krypto crash accelerates to Iran after Trump's bombing of the bombing

The cryptic market crashed accelerated on Sunday when the dealers reacted to the increased geopolitical tensions in the Middle East. The crisis escalated after Donald Trump bombed three nuclear destinations in Iran and thus risked a longer war in the region.

Iran and his Houthi leaders have sworn retaliation against the United States and Israel. In fact, Iran continued to fire missiles on Israeli goals on Sunday.

Bitcoin and other old coins crashed due to the importance of this attack. Historically speaking, risky plants such as stocks and cryptocurrencies fall off when a large black swan occurs. For example, after the recent day of liberation, they all rushed out on which Trump announced far -reaching tariffs.

Read more here: Axelar Price forecast: Why the AXL TOKE could recover

The crypto prices also crashed after the Covid 19 pandemic and the collapse of top crypto projects such as FTX and Terra.

The other reason is that the crisis in the Middle East will probably lead to higher crude oil and transport costs. Data show that crude oil from the Brent variety has increased by over 30 % in the past few weeks, and analysts fear that the price could soon increase to $ 100.

Higher oil and ship costs will make it difficult for the Federal Reserve and other central banks to reduce interest rates as inflation increases. Bitcoin and other old coins develop well when the Fed lowers interest.

Read more here: PEPE course forecast with risk of falling because a risky pattern forms

Important macrodata

With regard to the future, the most important catalyst for the cryptom market will be the reaction of Iran to Trump bombing. A sign of a limited reaction and conversations could give the hoped -for buoyancy.

There is a great risk if Israel and the United States attack Iranian oil refineries, terminals and energy systems. Such a step would press the cryptoma market down significantly.

The other important catalysts are the upcoming macroeconomic data from the USA, such as the GDP report on Thursday and the latest data on personal consumption expenses (PCE) in the USA.

Judging according to the past, it is likely that the Bitcoin and crypto prices will recover as soon as the geopolitical tensions decrease.