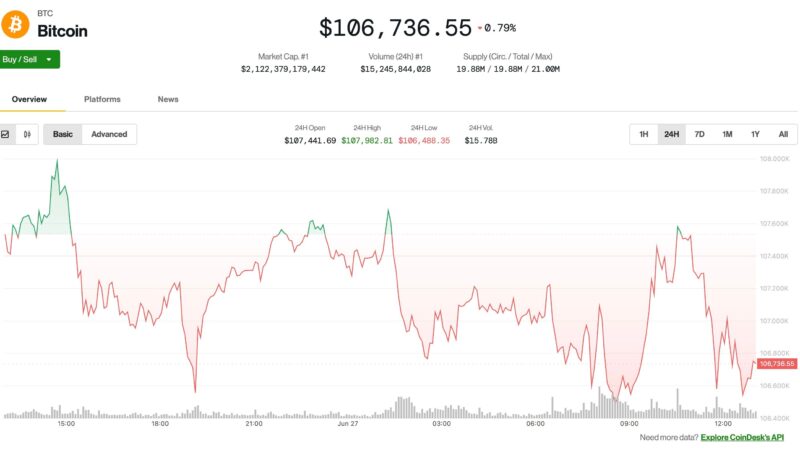

Bitcoin-Hashrates sinks by 3.5%, but miners can withstand despite the market weakness

Bitcoin's network hash rate has fallen by 3.5% since mid-June and has thus recorded the strongest decline in computing power since July 2024.

The decline takes place against the background of falling transaction fees and a weaker price development that the margins of the miners put under pressure after halving the block reward in April.

Despite the growing pressure, the expected wave of surrendering the miners has not yet occurred.

Miners sales activities remain behavioral

According to Cryptoquant, the drains from the Wallets of the Miner have decreased sharply – from 23,000 BTC per day in February to currently only 6,000 BTC. In addition, there were no larger BTC transfer tips on stock exchanges, which is a typical harbinger of mass sales.

Wallets, which are connected to miners from the Satoshi era, also remained largely inactive, with only 150 BTC that were sold in 2025, compared to almost 10,000 BTC in 2024. This indicates that long-term owners hold on their positions.

Reserves of the miners continue to rise

An important sign of the confidence is that the reserves of the miners grow, which indicates that most miners prefer to sit out the downturn than sell their coins at the current price level – while Bitcoin fluctuates near the local deep stalls.

“This further indicates that there is no sales pressure from the miners at these price levels,” concludes Cryptoquant.

Long -term strategy instead of panic

The data draw a picture of a mining sector that decides to hold-either in the hope of short-term recovery or as a conscious long-term strategy. Even in the face of falling incentives, most miners seem to be ready to burn cash instead of liquidating BTC to unfavorable courses.

While the Bitcoin network adapts to the Halving, the behavior of the miners remains surprisingly stable, which confirms the assumption that the pressure on the offer side is at least not a reason to worry.