Tuttle submits amendment for 2x crypto and meme ETFs that start on July 16

Important insights:

- Tuttle Capital is aiming July 2025 as the start date for the crypto ETF.

- The Solana Staking ETF from Rex-Osprey could influence the Market Timing.

- The 75-day review proposed by the SEC could simplify the approval of crypto ETFs.

Tuttle Capital has submitted a subsequent change in his registration declaration and thus took an important step towards the possible laying of several IPO-traded crypto funds. The change determines July 16, 2025 as the date of entry into force for a number of new products, including the Tuttle Capital 2x Long Daily Target ETFS.

These funds are a wide range of digital assets coverAmong other things, XRP, Solana, Litecoin, Bonk, BNB, Cardano, Chainlink and Polkadot. This step signals that these crypto -related ETFs could soon come onto the market, although regulatory hurdles and market conditions could lead to delays.

However, it is important to know that the change is not a guarantee of an immediate market launch. Earlier submissions indicate that the date of entry into force often indicates that the product is on the basis of admission, but the process is still subject to regulatory and market -related delays.

As Eric Balchunas, analyst at Bloomberg, noted, the date of July 16 could be a sign of the introduction of these ETFs soon after the first Canadian Spot XRP ETF was approved in June.

Rex-Osprey Solana Staking ETF Introduction

In the broader context of the crypto ETFs, Tuttle Capital's announcement comes shortly before another remarkable development in this area. The Rex-Osprey Solana Staking ETF ($ SSK) will come on the market the next day and will be the first US ETF to use Solana tokens. It is expected that this laying will arouse the interest of investors who want to invest in Solana through a regulated market -traded product.

The introduction of the $ SSK ETF is of great importance because its success or failure could have an impact on the time and success of other crypto -based ETFs. While analysts optimistically assess the potential of the product, the way in which the $ SSK ETF has been approved has raised some concerns.

Unlike others ETFs The approval was not an official sanction through the US stock exchange supervision. Instead, the SEC allowed the ETF to continue without an objection. This unique approval process has triggered a debate on the regulatory framework for cryptocurrency products in the United States.

SEC developments could change crypto ETF approval procedures

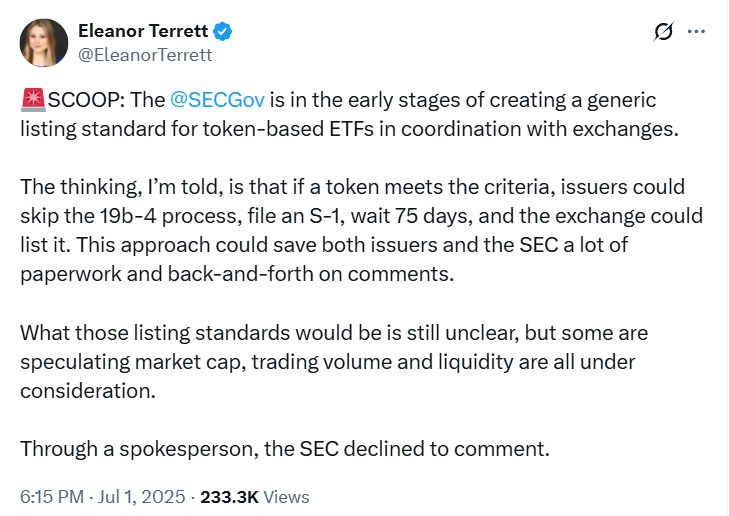

In the meantime, the SEC steps seem to be taking the admission procedure for crypto ETFs. According to an X-contribution by journalist Eleanor Terrett, the SEC reports on stocks to create a new admission standard for crypto ETFs.

If the proposal is implemented, emitters can submit an S-1 registration and only wait 75 days before a product can be listed, which significantly shortens the approval periods.

The SEC's examination procedure for crypto ETFs currently comprises several stages, including two 45-day windows according to Rule 19B-4, which adds up to 90 days. Emitters often have to expect even longer delays. Some are waiting for the final approval for six to eight months.

The new framework that abolish the 19b-4 step and focuses exclusively on the S-1 submissions could lead to a more predictable and more efficient schedule for approval. This proposed change could mark a turning point in the way the SEC approaches token-based ETFs, whereby the focus is more on disclosure than on the update of the rules. However, the proposal is still in the early stages, and no official schedule has yet been set.

SEC loosens procedure against crypto

The latest development indicates that the US stock exchange supervision SEC gives way to its attitude towards crypto finance products. The proposal to an effective examination period of 75 days for Krypto ETF Inserting could prove to be useful to simplify the approval work and make it more efficient and predictable. If this change is implemented, it would be an important step to integrate token-based ETFs into the wider financial market and would possibly reduce the delays and friction that mark the previous approval periods.

This change could be particularly profitable for an issuer like BitWise. The company's Ethereum ETF proposal, which was recently postponed by the SEC, would probably benefit from the faster approval process. A secure schedule would make the path of crypto ETFs less difficult and also accelerate the pace with which they are included in the mainstream investment funds.

Disclaimer

This article only serves for information purposes and does not represent financial, investment or other advice. The author or the persons mentioned in this article are not responsible for financial losses that can arise from investments or trade. Please research yourself before making financial decisions.