Bitcoin and Ethereum options for approx. 5 billion USD are running out today

Although BTC showed strength during yesterday's US session, retailers and investors should expect high volatility on Friday morning. Bitcoin and Ethereum options for over $ 5 billion expire during European trade lessons.

However, the influence could only be short -lived, since the markets quickly adapt to new trade environments.

Course effects of Bitcoin & Ethereum options

Deribit data show that today over $ 5.03 billion in Bitcoin and Ethereum (ETH) options will expire. For Bitcoin the expiring options have a nominal value of $ 4.3 billion and an open interest of 36,970.

With a put-to-call ratio of 1.06, the maximum pain level for the Bitcoin options that expires today is $ 108,000.

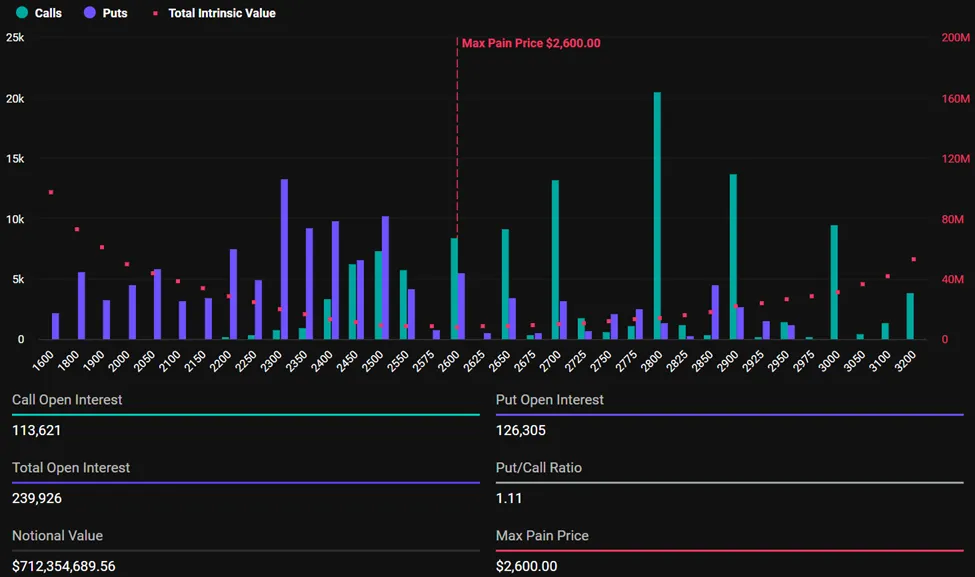

For their Ethereum counterparts, the nominal value of the ETH options expiring today is $ 712.35 million, with an open interest of 239,926.

As in Bitcoin The Ethereum options that run today have a put-to-call ratio over 1, with the Deribit data showing 1.11 at the time of writing. The maximum pain level or the exercise price is $ 2,600.

It is noteworthy that the Bitcoin and Ethereum options that run today are significantly higher than The last week. On July 4, leg crypto reported on almost $ 3.6 billion options, with 27,384 BTC and 237.274 ETH contracts that had nominal values of USD $ 2.98 billion and $ 610 million.

However, the main similarity between the expiring options of this week and the last week is that both put put-to-call conditions (PCR) over 1.

A PCR larger than 1 indicates that more puts (sales) options are traded than call (purchase) options, which indicates a bearish market substance.

Bitcoins PCR of 1.06 and Ethereums of 1.11 indicate a balanced bet among dealers between sales and purchase orders. This balanced perspective arises because investors speculate whether the market will decrease or secure its portfolios in the event of a sale.

Market analyzes and risks

Analysts at greeks.live notice a minimal consensus on the market direction, with most activities revolving news events instead of course analyzes. However, they also highlight high -risk trading activities and extreme risk behavior.

“Dealers discuss 500x leverage positions that appear from the current market levels. Despite the extreme risk, new positions are opened as interesting. Discussion of over 100 percent signal trade setups that indicate highly confident but risky strategies,” said Greeks.Live in one Contribution with.

It is noteworthy that trading with high levers of 500 increases both profits and losses. In the meantime Bitcoin and Ethereum well traded above their respective maximum pain levels.

At the time of writing Bitcoin sold for $ 116,823 after a new all -time high (ATH) has been reached. In the meantime was Ethereum traded for $ 2,970 after it has increased almost 7 percent in the last 24 hours.

The maximum pain point is a crucial key figure in crypto options. It represents the price level in which most option contracts expire worthless. This scenario causes the maximum financial loss or “pain” for retailers who hold these options.

The concept is significant because it often affects market behavior. According to the Max Pain theory, the course of the assets tends to approach this level when options are about to decay.

Since the options approach their expiry time at 8:00 UTC on Deribit, the courses from Bitcoin and Ethereum fall towards these levels. However, this does not necessarily mean that they fall completely to USD $ 108,000 for BTC and $ 2,600 for ETH.

The markets usually stabilize shortly after the dealers have adapted to the new price environment. With today's high volume of expiring options, retailers and investors can expect a similar result that may affect the market trends until the weekend.

Disclaimer

In accordance with the guidelines of the Trust Project, BeinCrypto commits an impartial, transparent reporting. This article aims to provide precise and current information. However, readers are recommended to check the facts independently and consult a specialist before making decisions based on this content.