Ethena crypto breaks out of the interest bullish Pennant

Important insights:

- Ethena crypto rose by 6.2% to $ 0.4105 after the outbreak from an interest bullish pennant; The upward destination is seen at $ 0.5988.

- Ethenas TVL reached $ 5.26 billion and approached the ATH compared to 25,000 in late 2024, while the monthly active addresses rose to 43,100.

- A decline of $ 1.3 billion on May 29 could trigger short-term volatility, but the financing remains stable with limited pressure on short positions.

After the outbreak from a bullish pennant, Ethenas of Natural Token, ENA, gains attention. However, the latest price stagnation does not reflect the growing interest in the protocol, as the increasing total value (Total Value Locked, TVL) and the continued activity of the users on the chain.

This happens before the decay of derivatives worth $ 1.3 billion on May 29, which could provide additional volatility at short notice. While the dynamics of the outbreak is still being checked, the strong liquidity, the growing construction activity and the stable financing rates indicate that Ethena is structurally healthy.

Ethena Crypto Price Action shows technical outbreak

At the time of the creation of this article, ENA/Usdt rose by 6.2% to $ 0.4105 after an outbreak from an interest bullish pennant on the 8-hour chart.

The outbreak of Worldofchartsfx also shows a possible upward destination at $ 0.5988 or 46% above the outbreak level.

Since the beginning of May This one In a triangle between $ 0.34 and $ 0.42 traded, with lower highs and higher lows. After a steady increase in volume and several successful tests of the support, the outbreak broke out.

In the meantime, the total value of Ethena (TVL) is $ 5.26 billion and thus just below its all -time high. This is in blatant contrast to the current token price, which is still well below $ 1.52, which he reached in April last year.

The token liquidity is $ 12.8 million and the token volume over 24 hours $ 286 million, which means that the current fully watered rating (FDV) amounts to around $ 5.91 billion. The annual protocol fees amount to $ 173.92 million and the income to $ 3.43 million. These figures indicate that the platform is still heavily used by the users.

However, the discrepancy between increasing TVL and falling price has attracted people's attention, especially since the protocol continues to record a stable capital inflow. This is unusual because the platform is used more via its stable assets Eusd and Susd.

Derivate decay adds volatility

On May 29, $ 1.3 billion will expire on Principal Tokens (PTS) in Ethena cryptocurrencies, based on Pendle data. While many due densities in commuters run without disorders, large returns can lead to slipping or short -term faults.

For Ethena, the EusD markets $ 143.7 million in liquidity and the SUSD markets $ 82.9 million. The annual percentage returns (APYS) are set to 11.4% or 11.28%. Despite attractive returns, there is a risk that the pools will be destabilized before the due date.

Dealers and liquidity providers pay attention to the volatility that results from the exit behavior. Sentora warned that early redemptions in thinner liquidity pools could lead to slippery, although the YT prices have remained largely stable.

Growth on the chain and neutral financing signal zinsbullische setup

Ethena Crypto reported 43,100 monthly addresses, compared to less than 25,000 in late 2024. Compared to the 25.4 million users of all StableCoin protocols, this is little, but with 0.2 % a growing market share.

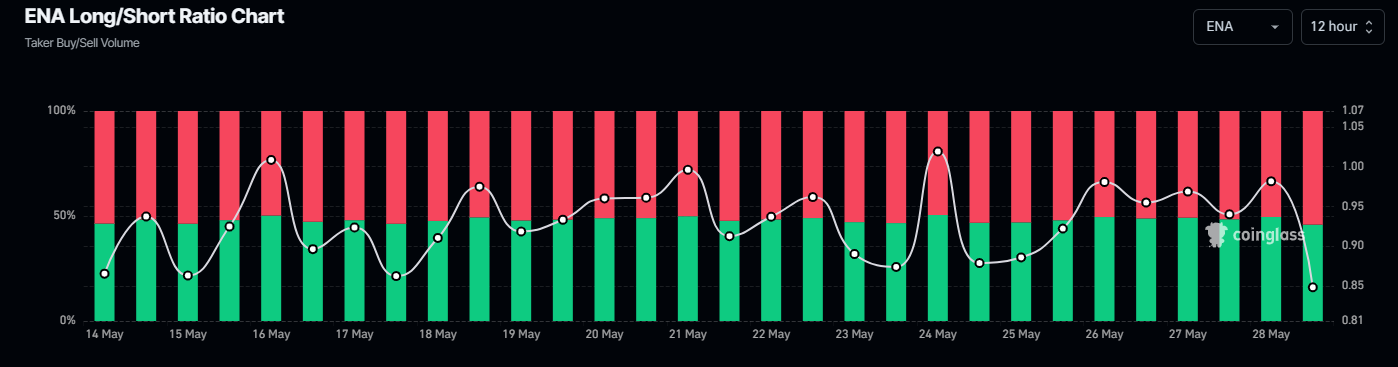

That fluctuated in the past two weeks This one Long/short ratio, but remained slightly declining. The refinancing sentences moved near the neutral area, which reflects a balanced demand for bulls and bears.

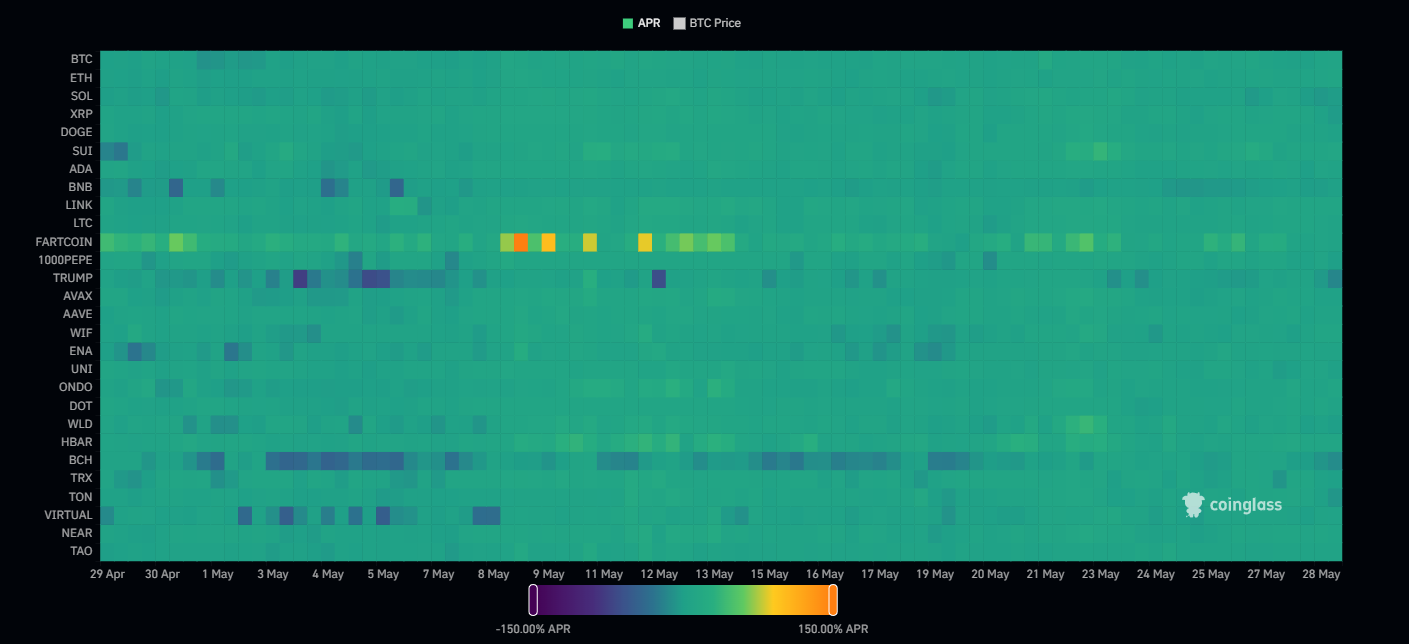

A HEATMAP comparison of the financing rates in the old coins showed low negative pressure on ENA. The data indicates that speculative short interest was limited.

In connection with the outbreak structure and the strong TVL growth, these trends indicated further upward potential. Although interest in empty sales continued, the technical setup and the trends on the ENA retail chain positioned for a possible continuation of the upward trend.

Disclaimer

This article only serves for information purposes and does not represent financial, investment or other advice. The author or the persons mentioned in this article are not responsible for financial losses that can arise from investments or trade. Please research yourself before making financial decisions.