Ethereum accumulation increases in a leap

A new report by Cryptoquant emphasizes the growing divergence between long-term Ethereum owners and short-term Bitcoin buyers, whereby in both markets there is a clear accumulation behavior in view of the increasing political and economic tensions in the USA.

According to on-chain data, Ethereum recorded a significant increase in long-term accumulation activities in June. During a phase of price consolidation, there was a significant purchase pressure of addresses that were classified as long -term owners.

The one published by Cryptoquant diagram Shows a clear divergence: While the ETH price moved sideways, the accumulation volume increased suddenly-often a harbinger of an outbreak.

This behavior reflects the trust of experienced investors who tend to buy in times of uncertainty when the activities of private investors go back.

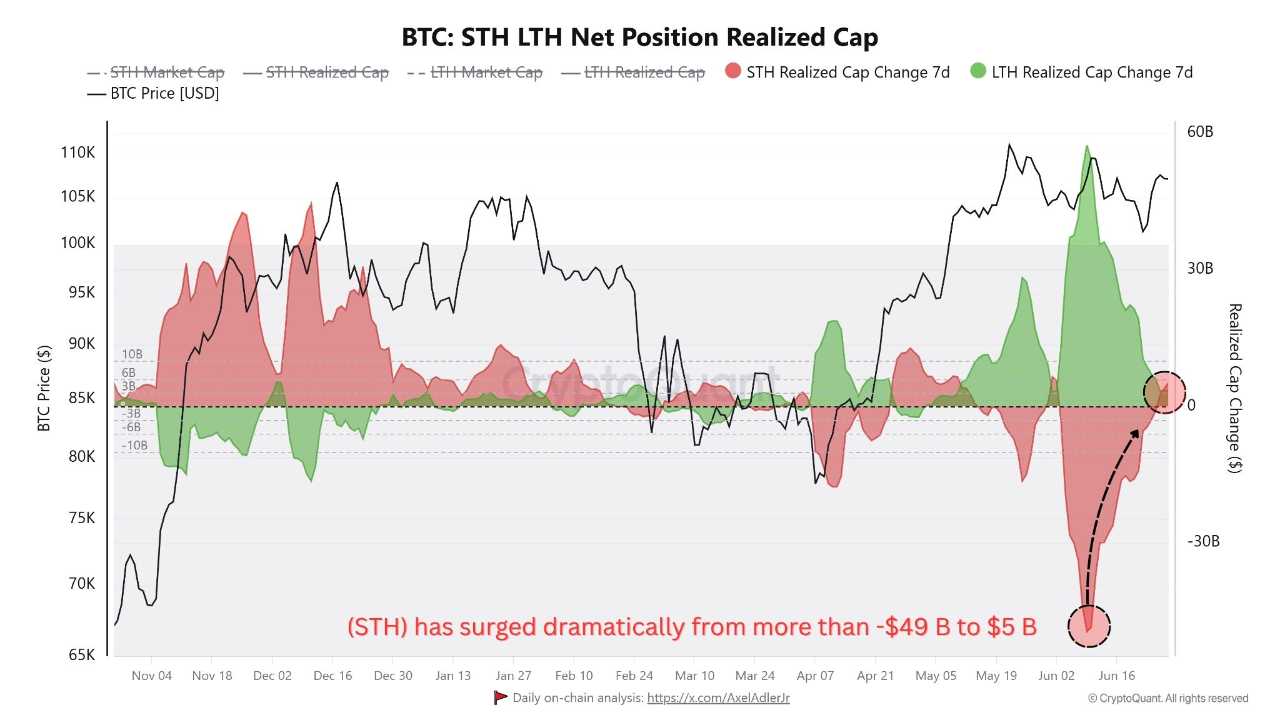

Bitcoin: Short -term owners jump on the train

Meanwhile, Bitcoin has a opposite trend. The realized net position of the short -term owners (STH) from Cryptoquant has increased from $ 49 billion over $ 5 billion in the last few days. This aggressive increase indicates a wave of newcomers – especially private investors – who buy Bitcoin to high courses.

In the past, such a behavior was a sign of an increased market taxhorie and often went hand in hand with local highs. The combination of increasing short-term interest and long-term ETH accumulation indicates a possible turning point on the market.

Binance-eth inflows give reason for caution

To make matters worse, the Trips from Ethereum zu Binance for five days in a row, which often indicates increasing sales pressure. Traders who transfer ETH to centralized stock exchanges could prepare for taking profits with them or reorganizing their portfolios – especially after weeks of sideways movements of the courses.

US politics could advance volatility

The on-chain signals are currently appearing at a time when the political situation in the United States is worried. President Trump recently asked the Senate to say goodbye to the “One Big Beautiful Bill”, a comprehensive package with tax cuts and suggestions for military spending. Legislation provides for considerable tax reliefs for seniors and employees and is positioned as a patriotic victory before the holiday on July 4th.

However, Elon Musk expressed concerns about the long -term effects of the draft law. He warned that uncovered tax cuts could increase the US deficit and have structural risks for strategic industries. Economists share these concerns and indicate that the draft law could lead to further debt and future inflation pressure without corresponding expenses.

Market outlook: divergences could resolve soon

In view of the political headwear and mixed signals from the blockchain, investors seem divided. The long-term owners of Ethereum are convinced that during the increase in Bitcoin purchases by private investors indicate that the fear of missing something returns. In conjunction with coincidences to Binance and macroeconomic uncertainty, the next few weeks could bring significant price movements on the cryptoma markets.