SEC gives the green light for Nasdaq Crypto Index with top altcoins

Important insights:

- The SEC approves the Nasdaq Crypto Index with the top altercoins Sol, ADA, XLM and XRP.

- Altcoin ETFs could be approved within 12 months and promote acceptance.

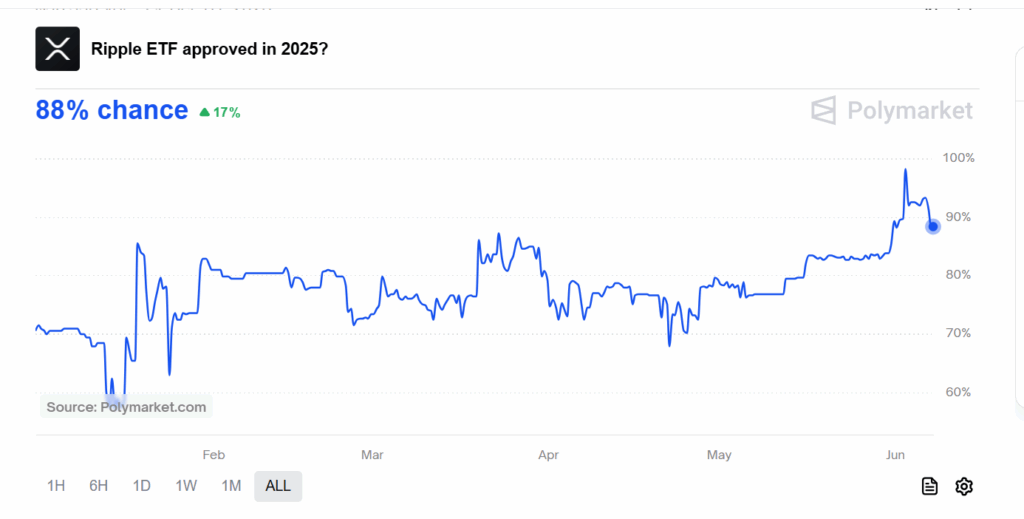

- Ripple ETF quotas rise to 88%, with XRP catching a target of $ 4.

The SEC has approved changes to the Nasdaq Crypto US settlement Price Index. Solana (Sol), Cardano (ADA), Stellar (XLM) and Ripple (XRP) are now included.

These tokens are part of the Altcoin index. Admission by the SEC means that these old coins are trustworthy and can be easily used on the cryptom market.

SEC permit brings recognition for old coins

The recognition of the Nasdaq Crypto Index through the Sec is an important milestone for Solana, Cardano, Stellar and XRP. Admission to the index provides these old coins with market data that institutional investors can rely on.

This step takes place after similar indices for Bitcoin (BTC) and Ethereum (ETH) have been approved. Both cryptocurrencies have recorded considerable growth since they were included in the index.

The approval of these old coins by the SEC clears the way for the approval of stock markets traded Spot funds (ETFs). The SEC has a positive attitude for the first time in years Altcoin-ETFs taken.

This reflects the growing trust in old coins that are listed in the Nasdaq Crypto Index. Approval means that the SEC sees these assets as centrally for the digital assets industry. If Sol, ADA, XLM and XRP are regarded as reliable digital assets, their acceptance could increase.

Cryptocurrencies could play a larger role in financial applications. A clear regulation could lead to institutional investors investing more serious in cryptocurrencies.

Riples ETF approval rates rise by 88%

After the SEC has approved the Nasdaq Crypto Index, the possibility of a ripple (XRP) ETF has increased. The latest market observation shows an increase of 80 % to 88 % probability for the approval of a Ripple ETF in 2025.

The market trust increases due to the positive news for Ripple. Positive regulations in the crypto industry also contribute to this trend.

The XRP lawyer Bill Morgan indicated this week that the 60 days that the SEC has for the decision about the Ripple case will end on June 16. This could lead to an early solution.

The approval of the SEC for an XRP ETF could be a big event for cryptocurrency. This could lead to significant changes in the market. People are now looking forward to possible altcoin ETFs, as the year brought Bitcoin ETFs' success.

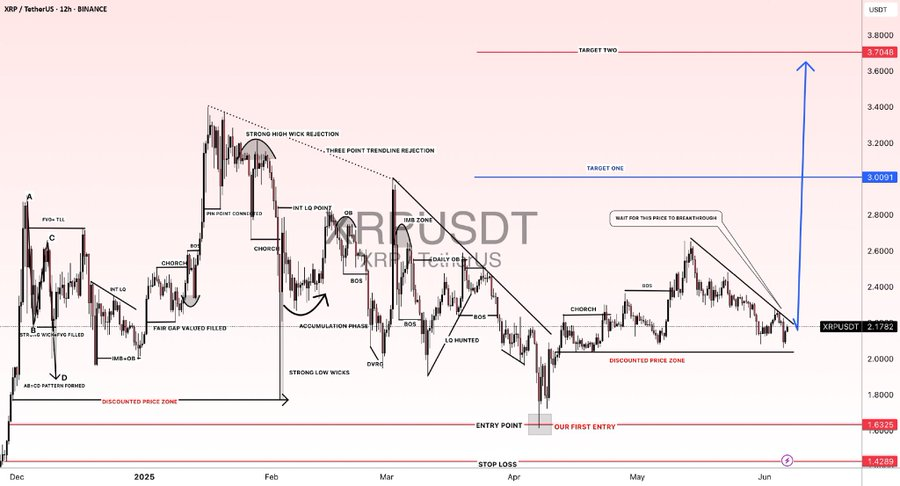

The market analyst dynamite_fix predicts an interest bullish outlook for $ XRP, with an expected gradual increase towards $ 4. The current discounted price zone at $ 2.00 offers an opportunity for long positions, with an entry point of $ 2.17.

The most important price targets are $ 3.01 and $ 3.70, which indicates growth potential. A strong interest in purchase and consolidation support the upward dynamics, with a stop looset being set at $ 1.42.

Other old coins show strong progress

In addition to XRP, Cardano (ADA) and Solana (Sol) also experienced a positive market mood after the announcement of the Sec. According to analysts, old coins such as Bitcoin and Ethereum will experience an increasing interest of institutions.

Cardano (ADA) shows interest -bearing potential because the RSI increases to 42.65, which indicates an increasing momentum. The MACD reduces the gap and thus signals a possible zinsbullic crossover. With a strong support, ADA could be ready for an upward movement at $ 0.63- $ 0.65.

Solana learns increasing interest, currently notes at $ 150 and has formed an interest bullish pattern that indicates that a price increase is imminent. If the key level is exceeded, investors can expect strong coin and minting on the Altcoin market.

At the time of going to press, the Stellar course At 0.2640, and the coin was in a downward pattern. This could lead to a sudden increase. Stricter regulations and the participation of institutions shape the crypto landscape. The biggest advantage of Stellar is its fast transaction system.

Disclaimer

The views and opinions of the author or the persons mentioned in this article only serve information purposes. And they do not represent any investment, financial or other advice. Trading or investing in cryptocurrencies is associated with the risk of financial loss.

Olivia Stephanie is a FinTech enthusiast with a keen understanding of financial markets. Her passion for economics and finance has led her to explore emerging blockchain technology and cryptocurrency markets.