The increase in Coin Days Destroyed indicates the course of the course

Recently, market analysts have their attention to an important one Bitcoin (BTC) Key figure directed – Coin Days Destroyed (CDD). This key figure rose sharply in July 2025, and analysts now fear that the Bitcoin course could soon fall considerably.

Although some explanations for the increase seem plausible, analysts continue to warn of the risks.

Was ist Coin Days Destroyed?

Coin Days Destroyed pursues the movement of bitcoins that have remained “dormant” for a long time. Analysts calculate the number of moving bitcoins based on the days they remained unaffected.

This key figure is important because it shows what long -term owners do. These investors usually understand the market cycles of Bitcoin good. When CDD increases, this often means that older owners sell what many see as a bear.

Cryptoquant data show that CDD has only been over 20 million from 2022. The previous four cases all fell together with large market returns. This most recent increase is the fifth case.

A historical transaction took place in early July 2025. 80,000 BTC worth over 8 billion USD were from a “sleeping” wallet from the early days of Bitcoin (around 2011) transferred. According to a report by BeinCrypto, this is considered one of the largest movements of coins that are over ten years old.

The transaction included eight wallets, each with 10,000 BTC and was carried out by an anonymous person or entity. When these Bitcoins were originally bought, the total costs were around $ 7,800 (based on the price of $ 0.78 per BTC in 2011). This shows the enormous profit that the owner has made.

Reactions of the analysts

André Dragosch, an analyst from BitWise, pointed outThat this transfer led to the second highest increase in CDD, which was ever recorded, only behind the event in May 2024.

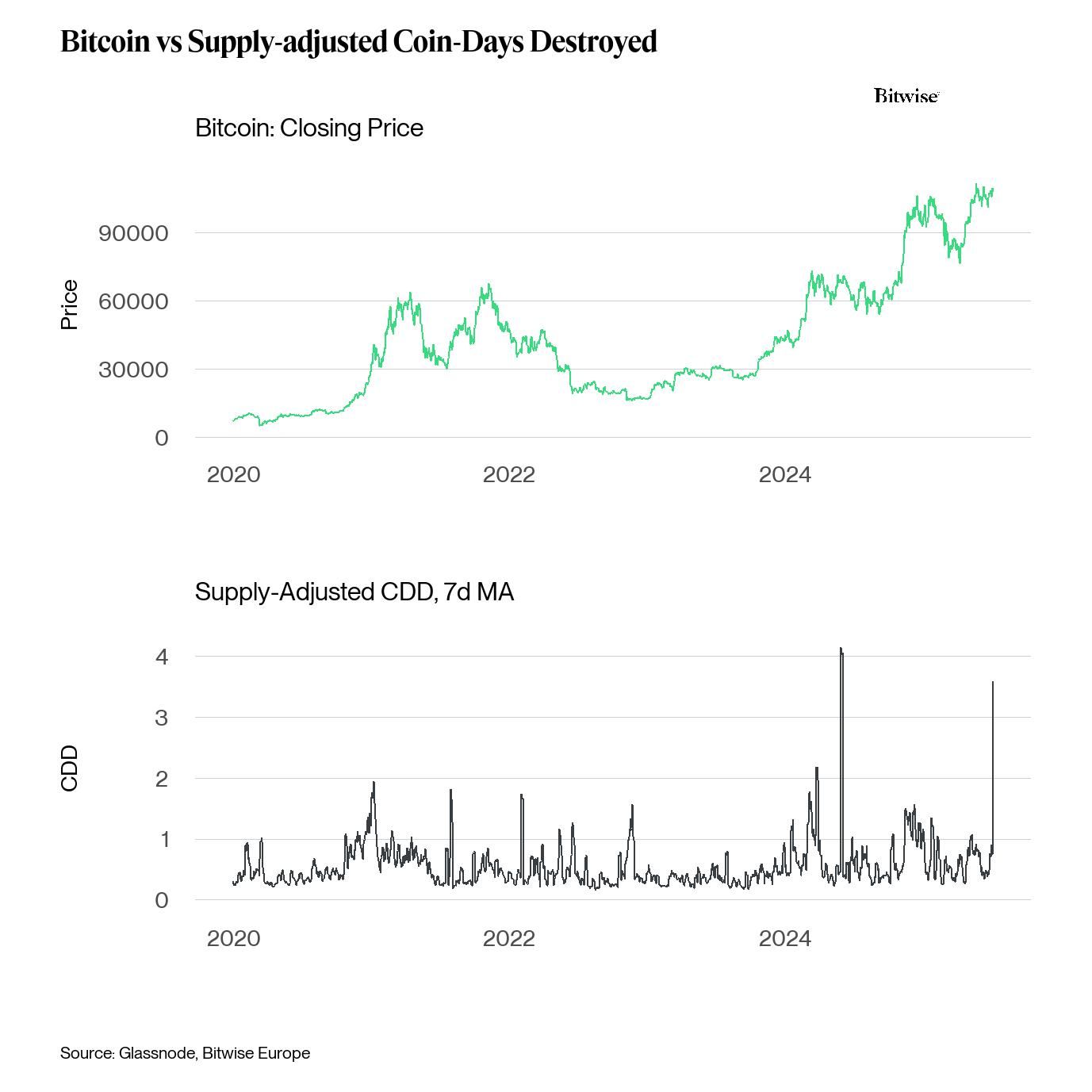

A Bitwise diagram compares the closing course of Bitcoin With the offered CDD (7-day average) and clearly shows the correlation. The Bitcoin course rose steadily from 2020 to 2024. But tips in the CDD often occurred shortly before course corrections.

The most recent event in July 2025 led to an unusually high CDD peak, which caused concerns that the market could soon experience a sale.

“The transfer of this 80,000 BTC led to the second highest increase in Coin Days Destroyed (CDD), which has ever been recorded. The movement of large amounts of older coins tends to have a bearish signal for Bitcoin to be”, ongthe André Dragosch.

In addition, Alex Thorn from Galaxy Research added that other days with a high CDD included the asset distributions from the Mt. Gox-Hack and the recovery of stolen Bitfinex money by the US government. Both events led to strong declines in the Bitcoin course.

“We haven't heard the whole story about these 80,000 BTC yet … and maybe never”, ” said Alex Thorn.

Although there may be reasonable explanations for the CDD increase in July-like Wallet-Restructuring Or security improvements – the story still shows that Bitcoin often experienced significant price declines after similar events.

Disclaimer

In accordance with the guidelines of the Trust Project, BeinCrypto commits an impartial, transparent reporting. This article aims to provide precise and current information. However, readers are recommended to check the facts independently and consult a specialist before making decisions based on this content.