Three crypto shares explode today-what is behind it?

Three US shares close to crypto are causing a sensation at the markets today. Core Scientific, Robinhood and Strategy Inc. provide new impulses by changing the board, takeovers and massive Bitcoin purchases.

The mood among analysts remains mostly bullish. What is behind the sudden interest in these three companies?

Core Scientific (Corz): Current market analyzes and developments

Core Scientific (Corz) closed yesterday with a moderate plus of 0.65 percent, after the share in pre -exchanged trade had already risen by 5 percent after Elizabeth Crain was appointed to the board.

Crain has more than thirty years of experience in investment banking and private equity. She was a co -founder of Moelis & Company and dressed management positions at UBS. It will also take over the chair of the examination board, a key position, since Core Scientific continues its strategic change towards an AI infrastructure.

Their appointment, together with Jordan Levy as President, marks a crucial moment for the crypto company, as it strengthens its management team as part of a more comprehensive transition to strategy and business operations.

The chart of Corz shows signs of new strength with a potential golden cross on the EMA lines. The mood of the analysts remains mostly bullish. 16 out of 17 crypto analysts classify the share with “Strong Buy” or “Buy”, with an average 1-year course goal of $ 18.28, which corresponds to an upward potential of 68.49 percent.

If the momentum continues, the next important resistance is $ 13.18, which could be tested at short notice.

However, investors should keep an eye on the support of $ 10.34 if it does not keep it, the share could fall back to $ 9.45 or even $ 8.49.

Robindhood (Hood): Current market analyzes and developments

Robinhood officially announced the takeover of Wonderfi for 250 million CAD, which is a significant step in its Canadian expansion strategy.

The deal, which offers a surcharge of 41 percent on the last closing course from Wonderfi, the 115-member team of Wonderfi and established crypto brands-bitbuy, coinsquare and smartpay-under the roof of Robinhood Crypto bring. The takeover is to be completed in the second half of 2025 and is expected to Robinhoods crypto presence in Canada Strengthen considerably.

Johann Kerbrat, CEO from Robinhood Cryptorecently emphasized the company's focus on tokenization and financial accessibility and pointed out how fragmented assets such as real estate can previously open inaccessible markets for normal investors.

The crypto company submitted a 42-page proposal to the SEC to a federal framework for tokenized real assets to accomplish. It aims to bring traditional financial markets to the chain with legally recognized asset token equivalences.

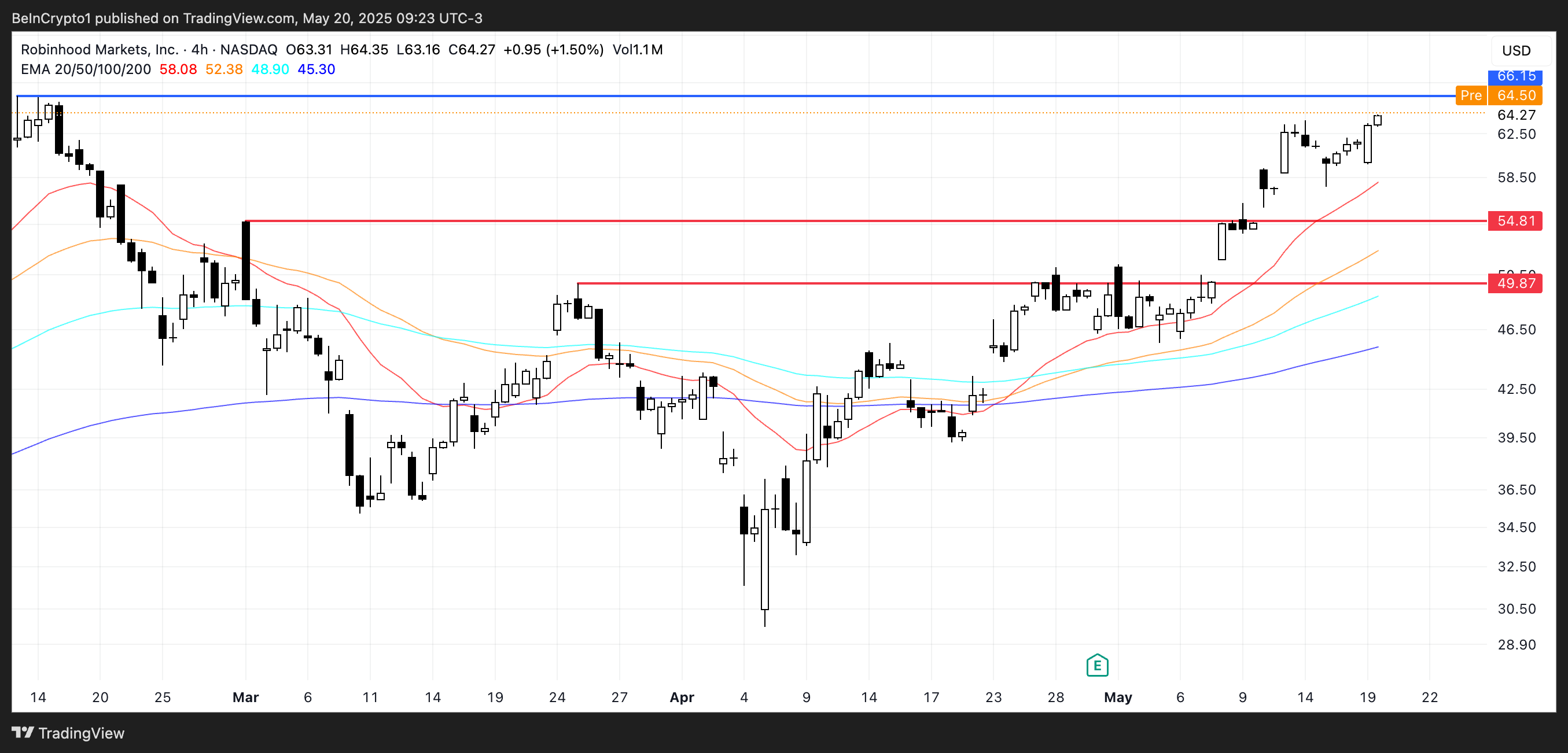

Hood shares closed yesterday with an increase of 4 percent and have risen slightly in pre-exchanging trade, which continues a remarkable rally of 56 percent in the past 30 days. Technically, the chart of the share shows strong swing, with the short-term EMA lines well above the long-term trend-what indicates continuing bullish atmosphere.

The next important resistance is $ 66.15; A clear breakthrough about it could Hood in unexplored area Drive, exceed the 70-USD brand for the first time and establish new all-time highs.

Strategy (MSTR): Current market analyzes and developments

Strategy (formerly Microstrategy) added another 7,390 BTC to his company treasury and spent around 765 million USD, while Bitcoin over $ 100,000 was traded.

This most recent accumulation increases the total stock to 576,230 BTC – acquired for $ 40.2 billion – which are now evaluated with over 59.2 billion USD, which reflects an unrealized profit of around 19.2 billion. However, the aggressive Bitcoin strategy continues to be criticized.

The crypto company and its managers, including the Executive Chairman Michael Saylor, were confronted with a class action lawsuit that accuses them of, the risks of their Bitcoin-centered investment strategy to have shown incorrectly.

Despite the regulatory pressure, Strategy is still the largest commercial Bitcoin holder. His Bitcoin-First approach has inspired similar treasury strategies in Asia and the Middle East.

MSTR closed yesterday with an increase of 3.4 percent and is 0.47 percent in the pre -exchanged trade. The share has increased by almost 43 percent since the beginning of the year. It notes near important support at $ 404, with the loss of which it could fall to $ 383.

If the dynamic increases again, the MSTR could increase to $ 437. The mood among the crypto analysts is good: 16 out of 17 stages the stock as “Strong Buy” or “Buy”. The average 1-year course goal is $ 527, which corresponds to an upward potential of 27.5 percent.

Disclaimer

In accordance with the guidelines of the Trust project, this price analysis article only serves for information purposes and should not be regarded as financial or investment advice. BeinCrypto commits to precise, impartial reporting, but the market conditions can change without prior notice. Always carry out your own research and consult a specialist before making financial decisions. In addition, the past performance does not offer any guarantee for future results.