Vivid establishes itself as a regulated crypto financial service provider

The financial platform Vivid has received approval from the Dutch financial supervision AFM (author Financiële Markten) through its Dutch subsidiary Vivid Money BV in accordance with the new European crypto regulation Micar (Markets in Crypto-Assets Regulation). As one of the first platforms under the new regulatory framework, Vivid is entitled to offer regulated crypto services across borders in all Member States of the European Union.

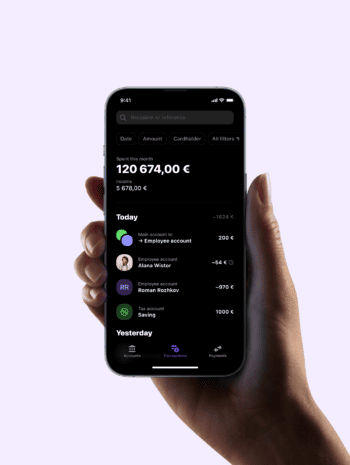

Caroline Pitzke for Vivid

Dhe EU regulation Micar, which comes into force in July 2025, is intended to create uniform requirements for providers of crypto-assets for the first time and thus establish regulatory coherence in a previously very fragmented market segment. For providers, the license means a significant surgical lever, because services that have previously been offered on a national approval basis can now be scaled under a centralized European framework across Europe.

So far, the Financial platform Vivid has been active with a crypto offer limited to Spain and Italy, but, according to its own words, is planning to gradually enter further EU markets, including Germany, France and the Netherlands. The existing crypto portfolio includes over 300 tradable cryptocurrencies that are secured with insurance protection via third-party custody. All transaction proceeds are credited to the Vivid account in real time, which ensures high liquidity for users: on the inside.

Focus on corporate customers

In addition to private customers, Vivid is increasingly addressing the business customer area, as the company has shown and stated several times in the past few weeks. As early as 2025, an earnings account for self -employed and small companies was introduced, which generates regular, weekly distributions on selected digital assets – without lock periods or capital loyalty. This product will also be made available under the micar frame in other EU countries in the future. Alexander Emeshev, co -founder of Vivid, emphasizes the strategic importance of admission:

The Micar license is a strong signal to our customers. Trust arises from clear rules, supervision and responsibility – that's exactly what Micar creates. For us it is not just about regulation, but about building a platform that can entrust people and companies to their financial future. ”

Alexander Emeshev, co -founder of Vivid

Regulatory tailwind creates credibility

Vivid

With the preservation of the Micar approval, Vivid underpins his claim to establish itself as a comprehensive financial platform for private and entrepreneurial customers. In the past twelve months, the company has won over 30,000 new customers and launched several new services-including a business travel tool, a SME investment program, corporate loans in cooperation with banxware and a cashback offer without upper limit.

The regulatory tailwind through Micar is a skillful move because it could not only bring new market access for Vivid, but also establishes the basis for a systematically scalable European crypto finance service sector. In a market that has so far been characterized by regulatory inconsistency, Vivid sets a signal for more transparency, consumer protection and infrastructure stability. The company emphasizes its strategic vision: a platform that combines classic and digital financial services under a regulated roof – and thus creates the basis for a new phase of European financial digitization. If you look at the history of the FinTech company, it is remarkable how agile (if you want to see it positively) the strategy has been adapted again and again. The start-ups have this high level of entrepreneurial freedom to the established banks. It will be shown whether the crypto-assets in particular can secure its success and credibility under (especially) business customers in the future.tw