Whale Move sends Aave Crypto to $ 25b TVL-IS $ 50B NEXT?

Important insights

- A whale delivered 3,196 ETH to Aave Crypto and thus strengthened confidence in the platform.

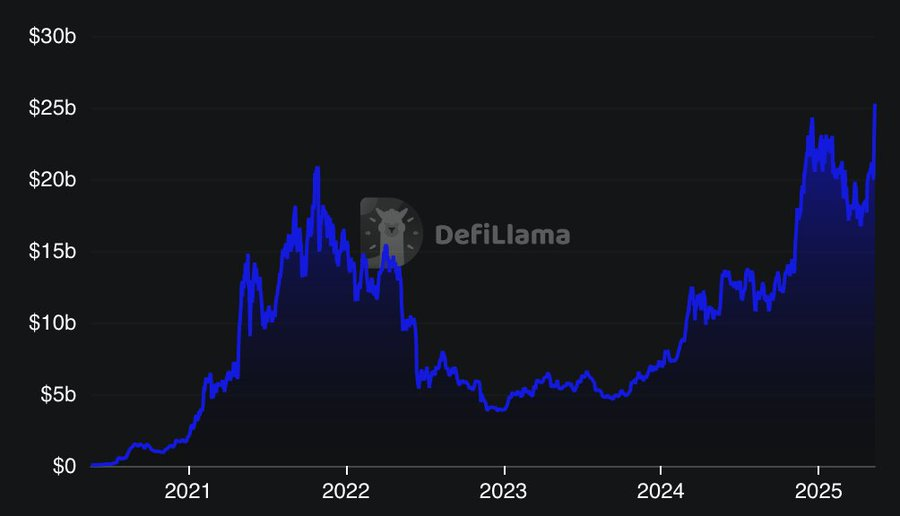

- TVL reaches an all -time high of $ 25b and is currently targeting $ 50b.

- The weekly chart shows interest bullies: $ 1,054, $ 1,675 and $ 2.297.

The total value of the cryptocurrency AAVE (Total Value Locked, TVL) has achieved a new all -time high of $ 25 billion and thus signals growing trust in the protocol. This increase is supported by increased market participation and remarkable activities on the chain.

A recently carried out transaction, in which thousands of ETH were delivered to Aave V3, has further reinforced it. With the increasing dynamics, analysts now focus on a possible increase to $ 50 billion in TVL and higher price targets for the token $ AAVE.

Whale transaction signals strategic trust in Aave Crypto

After the Onchainlens onchain data, a large Ethereum owner carried out a large transaction via the AAVE credit platform. The wallet has deducted 3,196 ETH worth around $ 8.03 million from Binance. Instead of selling the ETH or keeping them passively, the wallet provided the entire amount as security to AAVE V3.

Thereupon the user is worth $ 4 million against ETH and transferred the stable coins back to Binance. While the campaign may reflect different strategic intentions, ETH was not sold, which reduces the pressure on the market. This step indicates that the whale either generates liquidity by borrowing stable coins or plans further trade activities without giving up its ETH position.

Analysts consider this on-chain behavior to be slightly bullish, since ETH was removed from a central stock exchange and was instead included in Defi. This action typically signals a long -term stopping strategy or trust in the future price of ETH.

Aave Crypto TVL reaches $ 25 billion and ETH recovers

The increasing TVL from AAVE is dominated by the increase in ETH prices, since ETH is one of the most frequently used assets to store it as security in various defi protocols. The increase in the blocked total value is due to a greater increase in value of the assets in combination with an increase in user activity to credit and rental platforms.

Aave has exceeded the milestone of $ 25 billion TVL and thus set a new record that exceeds the highest level in the period 2021-2022. Defillama's records show that Aave's security values have risen continuously since the end of 2024 with a strong increase until 2025. While some other defi ventures recover more slowly than Aave from the last downturn, TVL from AAVE continues to rise.

We observe a recurring pattern that indicates that there has always been a relationship between the movement of the Aave token prices and the changes in the TVL, even if there were occasionally clear delays. Due to the increase in the TVL The crypto course goals for $ aave are now starting to reflect this upward trend.

Week chart shows interest bullies technical setup

According to the market analyst Dynamite_Fix, after a detailed analysis of the weekly chart, it was found that an increasing upward trend channel has established itself after the protocol broke out of a multi -year symmetrical triangle. Since the beginning of 2023, Aave's course has started to pull a sequence of ever higher levels of support and resistance from its trend reversal several years after he had reached its low point in the record prices of 2021.

Aave has recovered from the lower edge of the rising channel, and strong merchants have supported the increase in the price. Based on the Fibonacci expansion goals and the older resistance lines, the analyst expects AAVE to target the price levels of $ 1052 and $ 1675.

The support actively protects the bay at $ 185, an important position that coincides with the 0.236 fibonacci level and acts as the basis of the trend channel. If this support is preserved, it could maintain the interest bully impulse from AAVE and stimulate further price improvement.

Disclaimer

The views and opinions of the author or the persons mentioned in this article only serve for information purposes and do not represent any investment, financial or other advice. Trading with or investing in cryptocurrencies is associated with the risk of financial loss.